Don't Let Your Student Loans Delay Your Homeownership Plans

Don’t Let Your Student Loans Delay Your Homeownership Plans If you have student loans and want to buy a home, you might have questions about how your debt affects your plans. Do you have to wait until you’ve paid off those loans before you can buy your first home? Or is it possible you could still qualify for a home loan even with that debt? Here’s a look at the latest information so you have the answers you need. A Bankrate article explains: “Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.” This includes one of the biggest financial decisions you’ll ever make, buying a home. But you should know, even with student loans, waiting to buy a home may not be necessary. While everyone’s situation is unique, your goal may be more within your reach than you realize. Here’s why. Can You Qualify for a Home Loan if You Have Student Loans? According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000. That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says: “. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .” The key takeaway is, for many people, homeownership is achievable even with student loans. You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals. A trusted lender can walk you through your options based on your situation, and share what’s worked for other buyers. Bottom Line Lots of other people with student loan debt are able to buy their own homes. Talk to a lender to go over your options and see how close you are to reaching your goal.

Why Today's Seller's Market Is Good for Your Bottom Line

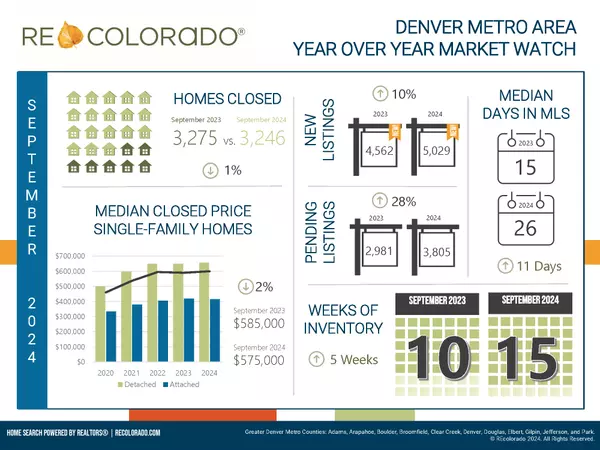

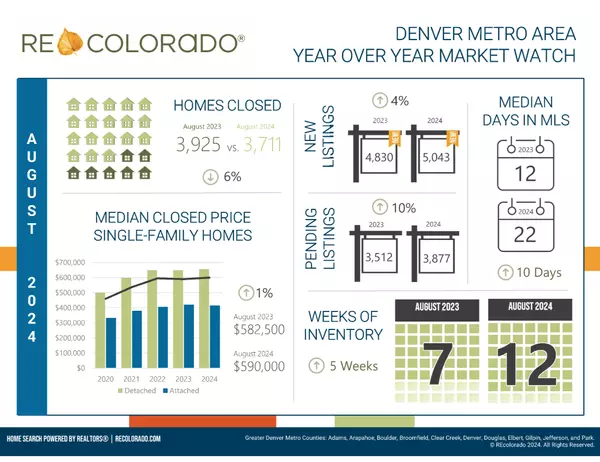

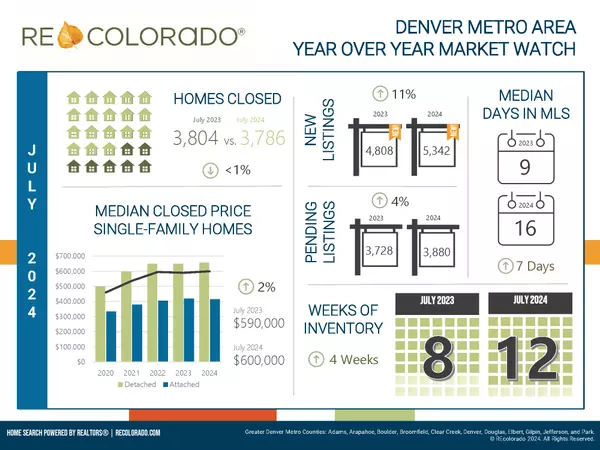

Why Today’s Seller’s Market Is Good for Your Bottom Line Thinking about selling your house and wondering if now’s a good time to do it? Here’s what you need to know. Even though the number of homes for sale has been growing this year, there still aren’t enough homes on the market for all the buyers who want to buy. So, what does that mean for you? To keep it simple, it means it’s still a seller’s market. Here’s how it works: A neutral market is when supply and demand is balanced. Basically, there are enough homes to meet buyer demand based on the current sales pace, and home prices hold fairly steady. A buyer’s market is when there are more homes for sale than there are buyers. When that happens, buyers have more negotiation power because sellers are willing to make compromises to close the deal. In a buyer’s market, sellers may have to do price cuts to re-ignite interest in their home, and prices may go down. But we haven’t seen this for years since there are so few homes available to buy. In a seller’s market, it’s just the opposite. When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. That creates increased competition among purchasers which can lead to more bidding wars. And if buyers know they may be entering a bidding war, they’re going to do their best to submit a very attractive offer upfront. This could drive the final sale price of your house up. The graph below uses data from the National Association of Realtors to show just how deep into seller’s market territory we still are today: What Does This Mean for You? The market is still working in your favor. If you lean on an agent for advice on how to get your house list ready and how to price it competitively, it should get a lot of attention from eager buyers. That means you’ll likely get multiple offers and see your house sell quickly and for top dollar. As a recent article from Ramsey Solutions explains: “A seller’s market is when demand for homes is higher than the supply of homes. And that’s still the case right now. If you’re planning to sell your house, you can expect to sell it fairly quickly for close to your asking price—as long as your asking price is realistic for the current market.” Bottom Line Today’s housing market still favors sellers. If you’re ready to sell your house, let’s connect so you can start making your moves.

What To Know About Credit Scores Before Buying a Home

What To Know About Credit Scores Before Buying a Home If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains: “A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.” That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains: “Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.” Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says: “While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.” If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on: Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly. Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible. Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score. Bottom Line Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

Categories

Recent Posts

GET MORE INFORMATION