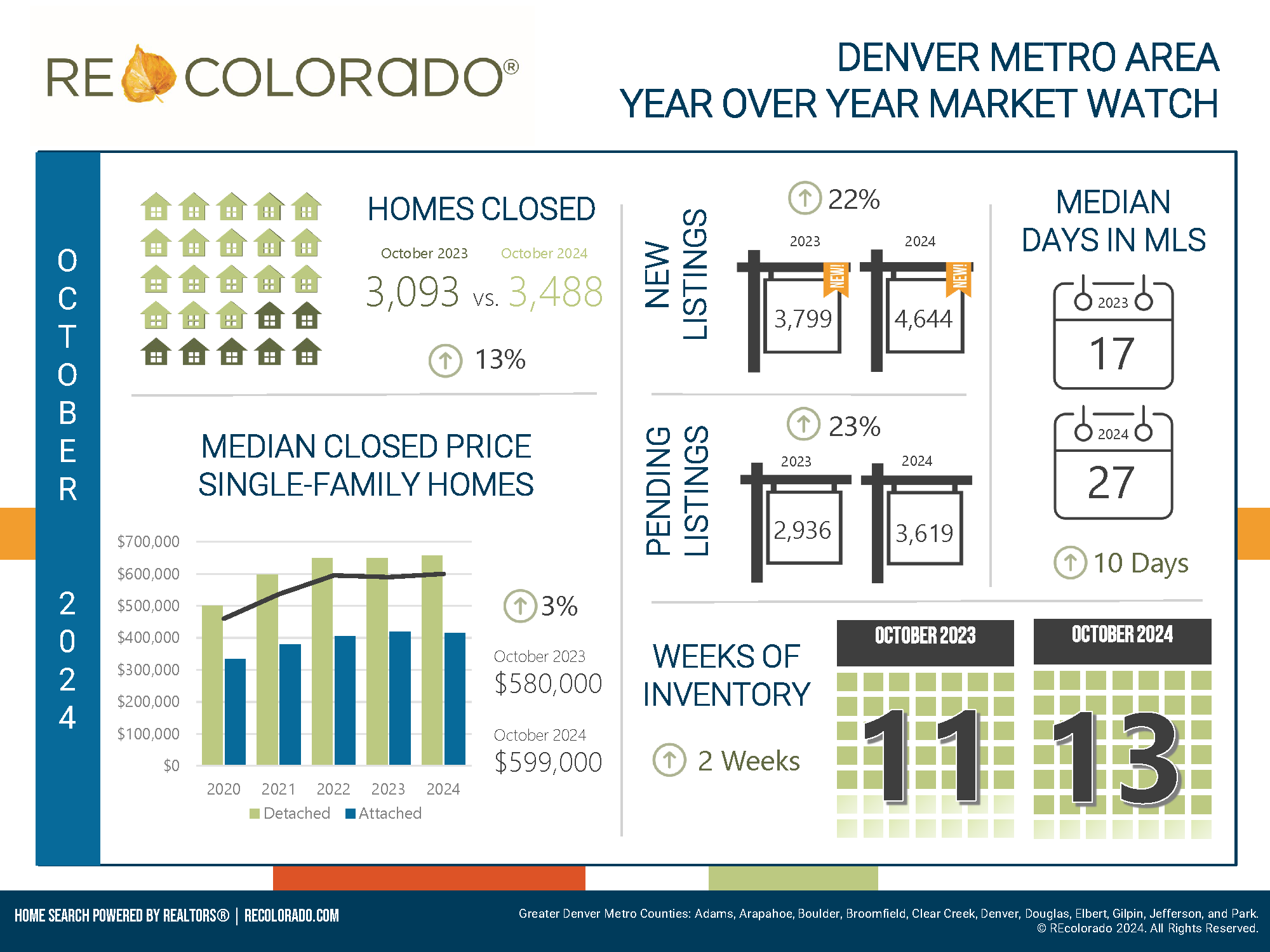

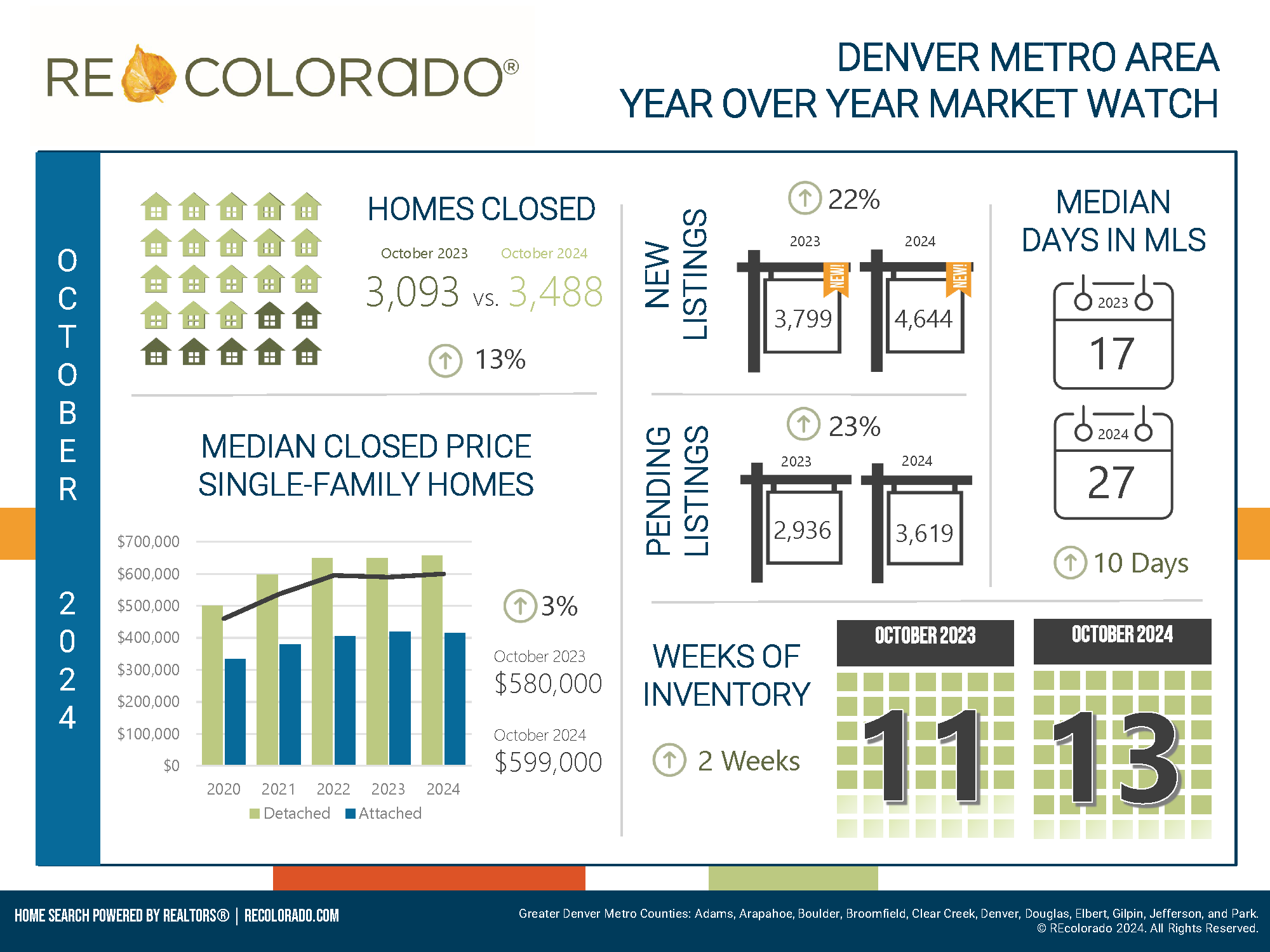

October 2024 Denver Metro Market Watch

October 2024 Denver Metro Market Watch October was a month of heightened activity for the Denver Metro Area housing market, according to recent data from REcolorado Multiple Listing Service. In fact, market activity surpassed what we’ve seen over the last two years. More homes closed in October tha

What's Behind Today's Mortgage Rate Volatility?

What’s Behind Today’s Mortgage Rate Volatility? If you’ve been keeping an eye on mortgage rates lately, you might feel like you’re on a roller coaster ride. One day rates are up; the next they dip down a bit. So, what’s driving this constant change? Let’s dive into just a few of the major reasons

Renting vs. Buying: The Net Worth Gap You Need To See

Renting vs. Buying: The Net Worth Gap You Need To See Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth. Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finan

Categories

Recent Posts

GET MORE INFORMATION